Trump’s Tax Plan SHOCKS Nation!

Could THIS Be

The END of Taxes?

Little-known 34-02 “Zero Tax” Loophole could end taxes for a small group of Americans

Dear Reader,

Despite raking in millions each and every year…

And despite ranking as high as #121 on Forbes’ most wealthy list…

You’ll never believe the shocking details of how Trump may have literally paid ZERO income taxes for up to 18 years.

And here’s the thing…

Buried inside his campaign financial disclosure form may lie a little-known loophole that could dramatically increase your wealth…

And change everything about your lifestyle when you retire.

It’s so powerful, in fact, it could END much of your tax obligations FOR GOOD.

This works if you make $1,000,000 or more a year…

It works if you make $100,000 a year…

And even works if you’re just making $10,000 a year…

When used correctly, this loophole can allow you to…

- Increase your wealth. One man took home almost 90% more after putting this kind of strategy to work

- Provide income for you to keep forever and spend as you please

- Keep that cash no matter what the stock market does

- Claim this extra money year... after year... after year

We’re calling it the “Zero Tax” loophole…

Simply because it’s based on the exact same 34-02 loophole that may have helped Trump (and a lot of other savvy tax payers) to beat the tax system for nearly two decades… Though there’s no guarantee your tax bill will drop to zero, this loophole could dramatically reduce it.

And there are similar deductions you can take advantage of to save thousands like these Americans…

“I saved $16,000 in taxes last year alone!”

— Andy & Tamar Fuehl, Chandler, Ariz.

“I went from the 18% tax bracket to the 8% tax bracket in the first year alone after using [these strategies].”

— George G. Cooper, Shreveport, La.

“I saved at least $4,500 per year over the last four years…”

— Kevin Miller, EGlobal Internet

“My husband and I saved almost $40,000 on our taxes by applying the strategies we learned…”

— Tracy Laws, Salt Lake City, Utah

And here’s what’s really incredible…

One Forbes writer estimates up to 90% of the people using little-known “Zero Tax”-type loopholes don’t pay traditional income tax.

And the Tax Foundation reports there’s been a 175% jump in Americans taking advantage of what Trump’s been rumored to do.

Make no mistake…

What I’ll show you today in this presentation could save you as much as $20,000 this year…

Another $20,000 the year after that.

And the year after that…

For as long as you choose.

But listen…

If you’ve never heard of the original 34-02 IRS regulation behind the “Zero Tax” loophole, it’s not your fault.

Despite these strategies gaining popularity, you won’t find any of them reported on in the biased, left-leaning media…

According to one study, in one year, only 3% of the total 140 million returns filed took advantage of one of the strategies you’ll see.

What’s worse is that your accountant probably doesn’t know about Trump’s alleged use of this original loophole either.

As you’re about to see, accountants, like lawyers and stock brokers, make their money by feasting on the income of the middle class.

They don’t care about saving you money.

They care about fees, hourly commissions or wages.

You’re just another number in their appointment book.

But the savings you generate after today’s presentation… whether $2,000 or $20,000… is yours to do with as you please.

The money you save in taxes and fees is not a loan…

There’s nothing to pay back.

After all, it’s YOUR money you’re simply putting back into your pocket.

You can use the savings to pay down debt.

To invest and compound into even more money.

Or to take a beach vacation.

But from that extra money, you’ll enjoy something more:

*** Wealth, independence,

freedom and security***

That’s why… for the few that DO know about this secret…

It’s being called…

“A Major Tax Break”

And others have called Trump’s potential use of the original loophole simply…

“Genius”

But here’s what’s really important for you to know…

To take advantage of what we call the “Zero Tax” loophole, there’s one 15-minute activity you MUST do before December 28 at 5 p.m.

Just know that that’s the government’s required time frame…

Not mine.

The good news is this…

This move takes just 15 minutes.

That’s all.

Once you’ve done this step, dozens of loopholes are suddenly open to you.

These loopholes can save you thousands of dollars.

Oh, and in case you’re wondering…

You Don’t Need to Lie, Cheat, Steal

or Go Offshore to Take Advantage of It

You don’t need a lot of time or a complex knowledge of the tax system to take advantage of this “Zero Tax” plan, either.

And you definitely won’t lay awake at night worrying about an unwelcome IRS agent banging on your door.

Because everything today is legal and ethical.

But here’s what you DO need…

- To have the desire — the strong, burning desire — to hang on to your money…

- To know the single best way to turn those savings into a massive compounded investing fortune…

- To know how to beat the IRS at their own game…

- And about a half hour of time each month (that’s all!) to put these tax-slashing strategies to work throughout the year…

So watch until the very end and you’ll discover exactly how to capitalize on these “Zero Tax” Plan strategies…

Because the truth is, as a hardworking American, you deserve a break!

Today, I’m going to show you how to get it.

I’ll also show you two “freedom” loopholes, as I call them, that you can take advantage of immediately to save up to $10,000 or more on this year’s tax returns.

If you like those loopholes, you’ll discover how to get the full details on dozens more Trump-type loopholes that can save you time and money.

They’re the kinds of loopholes that have been used by the wealthy over the years to keep large sums of their money from the government. As you may know, Trump is rumored to have used every loophole he could possibly find to lower his taxes, which is why we call these Trump-type loopholes. It seems no one has seen Trump’s taxes since the 1980s, so we don’t know exactly which loopholes he’s using today, but it’s safe to say he’d be a fan of using any loophole he legally can in order to protect the billions he’s amassed.

Things like…

- An easy way to deduct a portion of your mortgage or rent payments, without owning a home-based business and without breaking a single law

- The juiciest tax shelter? Hint: It has to do with your family. A $10,000 investment saves you $9,000 in taxes… year after year after year

- A second strategy to pay ZERO taxes. It’s called the “vanishing point.” And yes, as unbelievable as it sounds right now, there is a second legal way to pay $0 in taxes — and you don’t have to be poor or get into an iffy tax shelter to do it. The average American could walk away with $72,500 in completely tax-free income.

Not only will you see how to take advantage of the same kinds of tax strategies Trump may be using, you’ll see the stories of more than 100,000 Americans that are already using many of these strategies to essentially copy what Trump has been doing for years.

And you’ll discover these people are very much like you — hardworking, patriotic Americans with families.

But now — using the tricks and tools you’re about to discover — these Americans are slashing their tax bills, saving their own hard-earned money, growing that extra savings into fortunes… and legally “disappearing” off the IRS radar.

Gone are the money problems.

Gone are the sleepless nights… wondering if they’re overpaying.

Gone are the fears they’ve done something wrong and IRS bullies are coming for them.

Within an hour you could know everything there is to know about these little-known “Zero Tax” loopholes…

And how to put them to work for you… potentially saving thousands!

You’ll also be able to sit back and let out a sigh of relief knowing your retirement could be about to get a whole lot simpler, more lucrative and just plain more fun.

You could be taking more vacations, splurging more on your friends and just feeling more affable all the time.

That’s the freedom that comes from knowing how to make the law work for you.

But it’s critical you act on these strategies right now.

That’s why I’ll show you…

More Than 84 Trump-Type Tax

Loopholes "That Could Save You

$2,000–20,000 This Year!

Whether you want to just save a few thousand…

Or live the full “Zero Tax” lifestyle Trump seems to be living…

There’s one thing you must know about.

Dozens and dozens of tax loopholes exist.

Some small enough to save you hundreds each year.

And some large enough to drive a Greyhound bus through.

Just take a look for yourself…

- The “Rockefeller law” that lets you pay the lowest legal tax rate of ALL Americans… no matter your age or income. This underutilized move lets you get cash back from the government for annoying personal expenses from car payments to computers. This single loophole alone could save you as much as $4,600 this year

- Follow six simple rules about “home” ownership… and this tax-deductible gold mine could be worth up to $500,000 in tax savings for you

- Child or grandchild in the family? There’s a single move you can make to claim an easy $5,000 business deduction

- An unusual retirement account you must contribute to first to maximize your tax savings (SHOCK: It is NOT a matching 401(k))

- The “Intimate Co-worker” that allows you to potentially double, even triple the amount of money towards retirement. The only question is: Do you qualify for this weird-sounding program? About HALF of Americans do.

Now, maybe you’re thinking, sure, sure. This all sounds like a good thing… but I’ve got a GREAT accountant that handles this all for me…

But does he take advantage of everything the law offers? Every loophole? Every dollar he can save you? Every penny he can earn you?

Or does he simply collect your filling fee and move on to the next person like a human conveyor belt?

Chances are he has no idea about taking advantage of the “Zero Tax” plan, meaning you’re sacrificing a fortune… and putting yourself at even MORE risk with the IRS.

Here’s what I mean…

Did You Make the Simple, Common

Mistake That Could Cost You as

Much as $438 a Year?

Gone are the days when you trust your CPA or tax professional to get it right.

They think being conservative is the safe thing to do, but I’m here to tell you that’s a myth and it could get you in a lot of trouble.

In fact, CBS News reports that nearly HALF of all tax returns that overpaid were put together by a third party such as a lawyer or CPA.

The Government Accountability Office reported as many as 2.2 million taxpayers were overpaying their taxes by $438 per person…

If you make this mistake year after year, that turns into a $2,190 mistake in five years. And a $4,380 mistake over 10 years.

But here’s something disturbing…

Those figures were from 1998, when gas prices hovered around a dollar and Bill Clinton was Time magazine’s man of the year.

Can you imagine how much money the average American overpays today?

$1,000? $3,000? More?

$3,000 a year is an absolute fortune over time…

If you invested that money at a moderate rate of return, in just five years, you’d have an extra $22,570…

That’s unbelievable!

Why don’t more people know about the loopholes and strategies you’ll see today?

The truth is most CPAs and tax attorneys don’t know them. Maybe one in 100 understands what I’m talking about here today.

These accountants are more concerned with protecting their tail than getting you the maximum deductions the law allows. They want to collect your fees, file your taxes and move on to the next customer as quickly as possible.

Worse yet…

Not only do they miss deductions that could cost you money, but they set you up for audits and frustration, too.

Consider this story from Consumer Reports…

Mistakes and Bad Advice

In an undercover story, the popular magazine sent employees out to put CPAs to the test. Their findings were shocking…

A tester in Philadelphia handed her tax preparer Form 1098, a simple mortgage interest statement. The preparer turned to a co-worker and asked what to do with it.

The same preparer made numerous errors on the mystery shopper’s tax return including:

- Failing to recognize $3,500 in unemployment compensation as taxable income

- And neglecting to include another $25 in interest income.

In Durham, N.C., things took a turn for the worse. The tax preparer told the mystery shopper not to report a dividend as income. Oops!

The fact of the matter is your CPA (however nice he may be) doesn’t care about saving you money or helping you in deductions and write-offs.

You’re the one who pays if the IRS comes knocking.

And research shows there’s a HUGE risk of that happening when you use a third-party tax preparer.

When it comes to your money, no one will take as good care of it as you.

You know it.

I know it.

And that’s why the strategies you’re about to see are so important.

Remember, every taxpayer could save as much as $20,000 this year.

That annual savings can grow to an absolute fortune when you put the power of compounding to work…

Let me show you how…

The Greatest Moneymaking

Secret on Earth

You don’t have to be an investment wiz to grow rich…

You can build a million-dollar nest egg even if you know nothing about investing.

All you have to do is take your yearly tax savings and put them into a very conservative investment opportunity that safely takes advantage of the most powerful financial force on Earth…

Compounding interest.

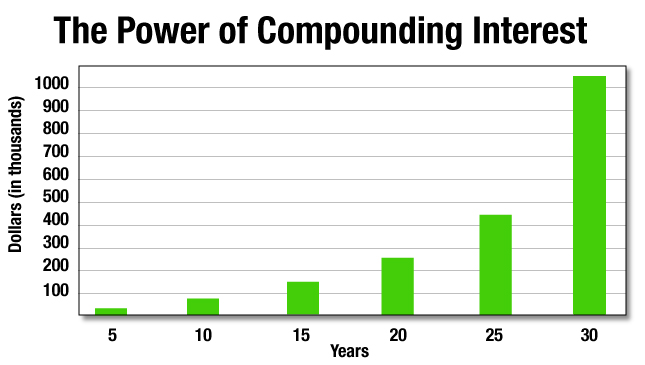

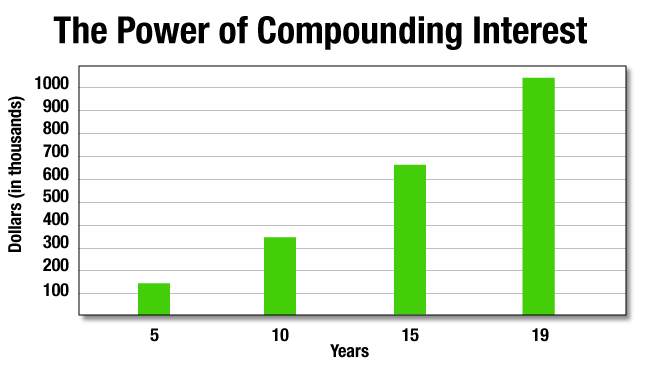

Just look at what can happen if you take a very conservative annual tax savings of $4,500 and compound it at a 9% annual rate:

You can grow an EXTRA million dollars!

Just see for yourself…

Using compounding interest, in 10 years, you’ll have $85,174.46.

In 15 years, you’ll have $160,400.

And in just over 30 years, you’ll have a million dollars!

- Without working an extra minute…

- Without scrimping and saving…

- Without doing anything risky or illegal!

Now, that sounds like a long time, but in a moment, I’ll show you how to reach that million in just 19 years using two Trump-type loopholes!

But first, just look what saving and compounding did for an IRS agent named Jeff Thompson.

His job at the IRS was to audit the tax returns of New York’s upper class.

First, he saw the amazing tax-slashing secrets these rich were using to legally shelter their money from taxes.

Jeff took those secrets and used the power of investing to turn his meager tax savings… into more than $22 million.

In fact, Thompson had so much money that upon his death he donated the bulk of it to his favorite college and even had a scholarship named after him.

Isn’t it amazing how saving just a small amount on your taxes this year can turn into an absolute fortune for you and your family?

And these are the very strategies that can protect you from the IRS.

No audits.

No frustrations.

Let’s get down to business…

The Greatest Tax Break of Your Life

Starts Right Now

A lot of taxpayers think tax time starts in April.

But that’s one of the biggest mistakes you can make as a taxpayer.

Dozens of loopholes are open to you year-round.

These loopholes can save you thousands of dollars. For example…

WORK

Employed but want to make a lot more money? The “Wake Up Late” loophole can increase your take-home pay as much as 18 times or more!

RETIREMENT

Which retirement account you must contribute to first to maximize your tax savings. (SHOCK: It is NOT a matching 401(k).)

HOUSE PAYMENTS

There’s a way to deduct a portion of your mortgage or rent payments, without owning a home-based business and without breaking a single law.

MEDICAL EXPENSES

The "Doctor's Secret" lets you deduct 100% of your medical expenses… saving you thousands even if you enrolled in OBAMACARE, MEDICARE or MEDICAID.

INVESTMENTS

A simple secret called the “Romney Clause” allows you to pay the LOWEST legal tax rates... This is the same secret used by former presidential candidate Mitt Romney to pay just 14% tax rates despite being a billionaire!

HOME REPAIRS

There’s an "Allowance" tax shelter that shelters a considerable amount of income from the IRS. Most people never use it. But it’s there for the taking.

COMPUTER COSTS

A specific type of popular tax software can cause penalties or trigger an audit. We recommend avoiding it at all costs. (DANGER: Nearly 30% of Americans could be putting themselves at risk for an audit by using this software.)

TAX-FREE INVESTING INCOME

There are 21 different, little-known ways to generate tax-free income that runs $51,456 or more. Some are right there in your city or state. Find out the number to call to claim this tax-free income today.

TRAVEL

What about travel? Feeling like you could use a paid-for vacation? The “Dream Retirement Fix,” as I’ve dubbed it, says follow six simple rules and this tax-deductible gold mine could be worth up to $500,000 in tax savings.

DAILY SPENDING

Sick and tired of saving receipts? Thankfully, the “Paper Saver” tax law lets you ethically deduct thousands in taxes without holding on to a single scrap of annoying paper.

In the end, using the “Zero Tax” Plan, almost all your important life decisions can be used to save you money. And it couldn’t be easier.

Set aside just 30 minutes at the end of the month to review your activities. Grab a piece of paper and match everything you’ve done up to one of these loopholes.

Everything from commuting costs to vitamins to eyeglass prescriptions can be used to save you money on your taxes.

So ask yourself…

How Many of These Legal Trump-Type

Deductions Did You Leave Off

Your Return Last Year?

- Your swimming pool

- Your chiropractor visits

- Your prescriptions

- Your home telephone bill

- Your gas and tolls

- Your hobbies and associated costs

- Your boats and other vehicles

- Your parents’ medical costs… even if they pay for them

- Your in-home parties… even if you don’t invite clients

- Your gifts… including big-ticket items

- Your motorhome

- Your closing costs

From birth to death, many of your daily activities can be used to save you money on taxes. All you need to know is how to apply each one.

When used properly, these strategies can save you thousands.

Those thousands, compounded the correct way, could turn into millions.

And that could mean the difference between living a life of riches and a life of just scraping by. They could mean the difference between saving thousands and living happy… and living in misery as you send the tax man thousands more than what you owe.

Let’s take an in-depth look at a two Trump-type strategies I recommend you begin using right now…

Trump-Type Easy Tax Strategy #1:

$10,000 Worth of “Ghost Income”

If you own your home, then you'll love this quirky tax surprise. It could show you how to put as much as a cool $10,000 worth of income into your pocket… tax-free.

Best of all, it's all completely legal.

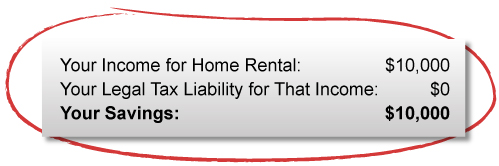

Most people don't know this, but current tax law allows you to rent out your home for two weeks, tax-free.

It's all part of Internal Revenue Code Section 280(A)(g) in particular. You can look it up to see for yourself. Here’s how it works…

Let's say you own a home in Texas, but you are planning on vacationing in Florida for two weeks.

Instead of leaving your home empty, you can rent it out. All the income you receive — be it $1,000 or $10,000 — is 100% tax-free.

Here’s an example of how it looks:

This tip works extremely well if you live near sporting venues, like those used for golf and tennis events. Athletes oftentimes roll into town and pay huge fees for short-term rentals.

It also works well during inauguration time in Washington, D.C. I've seen stories of homeowners in the D.C. area renting out their three-bedroom condos for $10,000 per week... again, all tax-free!

And here’s the best part…

Taking advantage of this strategy sends a message to the IRS.

A very subtle message that can’t be mistaken.

The message that you know all about loopholes, and that you plan to milk them for all they’re worth.

That kind of smart behavior marks you as a tax pro — someone the IRS doesn’t want to touch with a 10-foot pole.

They’ll leave you alone. And you could wind up richer.

Here’s another Trump-type strategy that can instantly save thousands on your next tax bill and send the proper message to the IRS…

Trump-Type Easy Tax Strategy #2:

A Quick and Simple $9,000 Savings

If you send your kids to college, is the college tuition deductible? Nope.

If you buy them a car and shell out a fortune for their room and board, is that going to save you any money on taxes? Nope.

If your daughter marries the man of her dreams and asks you to pay for that special yet pricey wedding, do you get to write that off? Nope.

But what if you could deduct the equivalent of all of this?

What if you could lower your tax bill by these costs… $50,000, $100,000… or more?

You can.

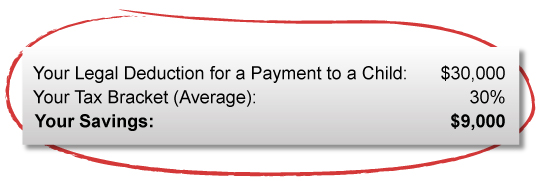

All you have to do is hire your children to do work for a business you own.

It’s really a win-win.

Your kids are putting in elbow grease for you. They get paid money to pay for their college, their cars and their future fun money.

And suddenly you can deduct all the money you pay them on your taxes.

So let’s say your daughter works for you. You pay her $30,000 over the course of the year — or approximately the cost of her wedding.

Here’s an example of how it would look:

And what’s even more exciting is your child pays no tax on the first $6,100 they earn each year.

Now that’s big news...

It’s like beating the tax system twice!

The loopholes really are endless.

And as you’ve seen, just a few of them could make a dramatic difference in your life.

How to Turn $19,000 Into

More Than $225,000

You’ve just seen how renting your house out could save you $10,000.

And you’ve seen how paying your kids could save you $9,000.

Added up, that’s $19,000 this year alone. But watch what happens when you compound that money…

At a conservative 9% rate, your money turns into:

- nearly $142,850 after five years…

- almost $333,400 after 10 years…

- And more than $1 million after 19 years…

And here’s where it gets REALLY exciting…

Say you’re able to produce better returns. Maybe 15% compound returns. Well, after 20 years, your initial savings today turns into more than $2,256,000.

Imagine what you could do with that money… without having to slave for hundreds of extra hours to get it?

How will your life be different when you discover the hidden wealth in your tax return?

What would it feel like to see that extra money every month?

What would be your first move?

Will you pay off debt? Buy that fast new car you’re always talking about? Invest in a property in a tropical paradise for pennies on what you’d pay here in the U.S.?

Or maybe you want to take a more charitable route and create a scholarship fund.

Whatever it is, you can make it your reality. And all it takes is the strategies you’re seeing today and less than an hour of work per month. That’s it.

Now I’d like to share with you some true-life success stories of people that have already “disappeared” from the IRS. These people now live lives of independence and financial freedom.

They’re not only saving money using these strategies — they’re sleeping easy at night, too.

SUCCESS STORY #1:

Stock Broker Walks Away From Career After Discovering “Manhattan Money Secret”

Meet John Tanner, a Wall Street stockbroker.

As someone deep within Wall Street, you’d think John would have known everything there is to know about wealth.

How to save it. How to grow it. How to hang on to it. But John was shocked when he finally found the tax-saving secrets I’ve been showing you. Let me explain…

John came from very humble beginnings. In fact, for years, he served as a missionary for his church and didn’t have a cent to his name.

After finding luck and fortunes in the stock market, John decided that New York wasn’t all it’s cracked up to be.

The more money he brought in, the more money the government took away.

But John was making a big mistake…

Put simply, his lack of Trump-type “Zero Tax” strategies caused him to overpay. And not by a little amount, either. (In a moment, I’ll show you how John saved nearly half a million dollars!)

Luckily, a well-connected banker in his early 40s let slip a tax secret that would change John’s life.

Put simply, John started a business. He ran ALL his expenses through that business… and was able to write off everything from his car to a portion of his rent to his home utilities.

And the business was nothing complicated. No brick-and-mortar shop to go to. No monthly leases, electric bills or vendors to pay.

He simply filled out a two-page form, wrote a check for $125 and started an LLC.

And this one idea saved John $480,000 in taxes over the next six years. That averages out to $80,000 per year — more than most people make in a year.

What’d he do with his savings?

John explored 19 countries… and the savings he found through this tax secret paid for his visit to every single one.

And here’s the thing…

Starting an LLC may be the single best tax loophole you can take advantage of. You may even be eligible to start a business right now… and retroactively write off PAST expenses.

And you don’t need to have customers… own a building… or do many of the things associated with a typical business.

But there are very specific steps you must follow — in a specific order — to make this all 100% legal. And you must do it by 5 p.m. on December 28 of this year. That’s the time frame the government’s set for you to take advantage of everything you’ve seen today. I’ll show you the details on how to learn those steps in a moment.

Here’s another story you’ll enjoy…

SUCCESS STORY #2:

Veteran Defies Accountant

and Pockets an Extra $50,000

George Riley never thought of himself as tax savvy.

As a Navy man from Indiana, he’s always hated cold weather… hated the IRS… and hated bureaucratic waste.

Hell, all he ever really wanted to do was get a tan, travel and work on his golf swing.

He never imagined a very specific tax loophole would make it possible for him.

Recently, that’s all changed…

Just listen to what he told me.

“My friends were doing the things I wanted to… going down to the range every Tuesday to try out the latest and greatest driver, spending weekends in Cabo… One of them even started making his own wine and visiting wineries around the country. I thought, gee, these guys aren’t smarter or better off than me… how are they doing this?

“That’s when I discovered what you call ‘IRS-Proof Fun.’ I was amazed at what the government lets you write off.

“I could take tax-deductible vacations, tax-deductible golf trips, and in many cases, use my personal expenses to lower my tax bill.

“But my accountant didn’t want me to take advantage of it. He was afraid it would flag me for an audit.

“I did it anyway… and turns out I was right.

“And it’s saved me $50,000 so far.”

We were shocked by his findings.

But George is not the only one making this secret work…

SUCCESS STORY #3:

Mother Embarrasses Daughter Into

Taking Tax-Free Travel

31-year-old Linda Bernstein loves travel too.

That’s why she scrimped and saved to visit the world-famous beaches in Mui Ne, Vietnam… the towering peaks in Machu Picchu, Peru… and the salmon-rich waters in Kenai, Alaska.

She was shocked to discover her friends were taking these trips on Uncle Sam’s dollar.

“I felt like a dummy,” she said.

“I literally threw more than $20,000 down the toilet by not using what you call ‘IRS-Proof Fun’ all these years.

“I’m embarrassed to say my mother turns 60 this year, and she started using this secret before me. That statement just doesn’t feel good when I say it.

“You might think my mom is really smart when it comes to taxes and loopholes, but it’s the opposite.

“She doesn’t even have an ATM card because she thinks dealing with pin numbers is too complicated.

“That’s really what convinced me to make the change. If my mom could do it… I figured anyone could.

“Now I spend less than one hour a month tallying what the U.S. government owes me.

“My friends believe I’m living the dream… and I guess I am.

“Next week, for example, I’m taking a $600 Disney cruise, and the whole thing is an IRS-approved write-off.”

Linda’s story is encouraging. Your life could be this way too.

So maybe you’re wondering who I am. And how I’ve found all these loopholes and strategies. Allow me to introduce myself…

Confessions of an

Ex-IRS Hit Man

To tell you about who I am, I must first tell you the story of a man named Bill.

Bill was an IRS agent. One of the best.

But his whole life changed one day. Let me explain…

Bill was standing in court, across from a tax evader.

Bill knew he could nail this guy for over $2 million in unreported income.

There was only one thing that could save him… a simple sentence that would get him off the hook.

But in over 200 cases in the past few years… only one person used this IRS secret — a simple phrase — to save his skin.

(I’ll share with you this single sentence in a moment. You’ll be able to use it to save yourself in ANY audit, too… even if you’re guilty! But back to our story.)

Somehow the defendant knew this secret, and several others that helped him run circles around Bill and completely changed his view of the U.S. tax system forever.

He never imagined the laws that bind U.S. taxpayers would give Americans so much power over the IRS… and prevent him from collecting taxes.

But that day… everything changed.

You see, before Bill came to the IRS, he was a partner in a tax firm. Day in and day out, he slashed taxes for his clients and fought the IRS…

He knew the laws inside out. He thought like a business owner… like a taxpayer.

He understood the taxpayer mind and could cut to the chase when figuring out what they really owed the IRS.

So when he made the jump to the IRS, it made perfect sense for him to look into complaints and review other auditors’ work...

But the work sickened him.

Day after day, he saw taxpayers abused… bullied… and cheated by their own ignorance and fear.

While a handful of entrepreneurs got rich by understanding the system.

After reviewing a tax return where an agent overcharged a Christian contractor $98,000 and almost cost the contractor and 15 employees their livelihood...

Bill had had enough.

He packed his bags and left the IRS forever.

But he never let go of his ties on the inside.

He never gave up his friends in the IRS or his passion for getting the honest taxpayer back every hard-earned cent they deserved.

And he never stopped helping people beat the IRS.

In fact, if it wasn’t for Bill… I wouldn’t be writing you today.

Hi, My Name Is Gail Dent

(Pseudonym)

And Bill was my father.

I’ve always been a daddy’s girl. I loved being around my dad — everywhere he went, I followed him. Everything he did, I watched.

When he played sports, I played sports. When he read a magazine, I read a magazine. When he sat around talking to his IRS buddies…

I sat around listening. I was like a fly on the wall.

My babysitters worked for the IRS. My parents’ friends worked for the IRS.

It seemed every adult in my life knew something about taxes and the IRS no one else was on to. And that’s when I began to dig a little deeper...

I asked my dad for names and numbers. His best sources inside the IRS.

I called my uncle, a high-ranking federal official. And he dropped a bomb on me — almost absentmindedly — that has the power to change the financial destiny of every taxpaying American in this country.

My uncle revealed an unusual strategy used almost EXCLUSIVELY by IRS agents and the very, very wealthy to build large fortunes and completely VANISH from the IRS.

And that’s how I discovered these little-known Trump-type loopholes…

Today, I’d like to share with you ALL the details on what I’ve learned over the past 25 years.

Secrets, strategies and loopholes that (literally) took me a lifetime to discover. Things like…

- Six little words that will stop ANY audit cold… even if you’re guilty (It actually works to protect you in other court cases as well. I’ll tell you why in a minute)

- A tried-and-true system of sorts that taxpayers use to run CIRCLES around the IRS…

- A special “gang” of IRS veterans who can beat the pants off any IRS agent in a tax dispute… and will fight ANY tax battle for you. And guess what? They are PAID FOR by the U.S. government (I’ll show you how to get their contact information at the end0

- The cellphone secret that cuts through IRS red tape… and lets you speak to a decision-maker

- Something called the “Christmas Miracle” that lets you wait until December to send any money to the IRS... without penalties, without flagging yourself for an audit and without taking a single questionable deduction

- The “Adventure Travel Trick,” and how to use it to save half a million dollars in taxes over your lifetime

- How a former IRS agent turned $5,000 into $22 million using what he discovered inside other people’s tax returns… this is an incredible story. You don’t want to miss it

- What to do when an IRS agent is at your door. Hint: It depends on what kind of agent it is… one agent is there to get you on criminal charges, and the other is just a typical agent. The implications are immense. Don’t say a peep to them until you find out what this is. I’ll let you in on all these secrets today.

I’m discussing Trump’s plan, and every single one of these secrets…

More than 84 of the juiciest ones in total…

The best I’ve discovered over the course of my entire life…

Inside a special report called Trump’s No-Tax Plan: What Every American Needs to Know Before the End of the Year.

I recommend that you DO NOT file your 2016 taxes until you read this report.

With access to it, you could shave as much as $20,000 off this year’s taxes alone.

And you can see how to grow those savings into $100,000… $200,000… even $500,000 by putting it to work compounding interest.

Here’s how to claim your copy…

Your Path to Better

Living Starts Right Now

To grab your free copy of Trump’s No-Tax Plan: What Every American Needs to Know Before the End of the Year, all you have to do is agree to try the research in our one-of-a-kind monthly publication called the Laissez Faire Letter.

The term laissez faire is French. It means “let them be.” And that’s exactly how we believe the world should work…

We should be free to enjoy a life well lived. Free to enjoy the money we’ve earned. Free to spend it… save it… or give it away to whomever we choose.

In short, our goal at the Laissez Faire Letter is simple:

We strive to show you how to live a happy, healthy and wealthy life… using 100%-legal strategies to earn more money, receive better health care, and save and grow your wealth.

Our panel of experts include a self-made millionaire, a three-time New York Times best-selling author, one of the world’s leading privacy attorneys, a tax consultant to the world’s most wealthy, a former CIA officer, a cutting-edge health care expert and more.

These esteemed men and women have been featured in Forbes, Money magazine, Entrepreneur, The Huffington Post, The New York Times, the 700 Club and many more publications…

Each month, they come together to deliver Laissez Faire Letter readers dozens of the most potent, never-before-seen legal loopholes — specifically designed for getting ahead in today’s changing America.

And taxes aren’t the only thing we can help you out with. With your trial subscription, you’ll learn how to…

- Grow your wealth outside of Wall Street schemes, using little-known but proven strategies

- Save thousands on your health care, even during the age of Obamacare

- Give yourself a “health makeover.” Even if you’re 40, you’ll feel like you’re 20 again. Fit, full of vitality and in glistening good health

- Fascinating hacks that make you so much more productive and effective in your life

- Ways to increase your privacy — both online and at home — so you’re free from the government’s prying eyes…

Here’s something else that our members have found extremely helpful. See if you find it as fascinating as they have…

The Book Congress Could Want to Ban

You’ll never believe what Congress and politicians like Hillary Clinton are up to. In short, they are getting away with something BIG.

Tucked away in 75 fast-reading pages are secrets to how thousands of American seniors have hacked Congress’ most lucrative perks, including free medical care, free money in retirement, free resort vacations, preferential treatment from the cops and much, much more… but you may never get the chance to see them!

If Congress knew exactly what was in this book… they could be furious. That’s why I want to send you a free copy of this book today, before we are issued a cease and desist letter.

What’s being exposed is already having a major impact on the lives of everyday Americans. In fact, thousands of Americans are getting richer thanks to what’s being learned from this book. They’ve discovered things like:

- How to access what we call the “Senate Income Stream” and earn as much as $50,000, $100,000 or more, even if your credit score takes a dive and you’ve been out of work for months (Page 31).

- How to get free gold, silver and more from what could be one of America’s greatest mass movements. You can sell it, keep it or just gift it to a friend (Page 64).

- How to earn as much as $1 million in extra cash using a “Federal Income Trick” we discovered inside Congress’ tax returns. Revealed by an Emmy Award-winning investigator, this trick essentially “sneaks” you access into the same kind of perks as the world’s best retirement fund (Page 40).

What you find could change your life too… especially if you’re disgusted by our political system and you’re not scared to try something new.

If you’d like to see what Congress is doing and why it could immediately impact you, we’d like to give you instant online access to this free gift. A brand-new book called Get What Congress Gets.

Never released before in bookstores, the only way to get this book free today is by taking a trial subscription to the Laissez Faire Letter.

Like your tax savings report, this controversial book is also yours free with a trial subscription to the Laissez Faire Letter.

But maybe you’re wondering if a subscription is right for you?

Start Living a Healthier,

Wealthier Life Today

With the Laissez Faire Letter, I promise you’ll be the first to know of hundreds of strategies, ideas, secrets and techniques unknown to the general public. It’s like having your own team of experts on your side, sending you a steady flow of inside information.

I promise you’ve never seen anything quite like it. But don’t take it from me.

Take it from a few of our 100,000 Laissez Faire Letter readers who wrote in during the past few weeks…

“An excellent subscription, full of useful data. A must-read in every area.”

- Robert C., Austin, TX

“Good information and thoughts by many in the know.”

- Donald R., Chicago, IL

“The Laissez Faire Letter gives you solutions you aren't likely to find anywhere else.”

- Mary F., Columbus, OH

“Action, action, action, useful input that works!”

- William D., New York, NY

“If you want to keep your sanity, and your money, read this letter.”

- Samuel P., Fort Myers, FL

“You can’t afford not to subscribe.”

- Linda M., Chattanooga, TN

“It is the best source of information that works than anywhere else in the industry.”

- Kenneth O., Alexandria, LA

“If you want information that is researched, tested and thought-provoking, then Laissez Faire is right for you.

- Sharon T., Columbus, OH

So how much is a membership to the Laissez Faire Letter?

It’s not $200.

It’s not $100.

It’s not even $50 per year.

Truth is I think you’ll find it ridiculously cheap.

But there’s something else you’ll receive for FREE when you take a trial subscription to the Laissez Faire Letter.

Something I think you’ll find extremely valuable. It’s called Laissez Faire’s Big Book of Free.

Laissez Faire’s Big Book of Free

I’ve tucked away all of my most valuable secrets in an incredible book of freebies called Laissez Faire’s Big Book of Free.

You’ll never see this book on any bookstore shelf or website. The secrets revealed in it are, I believe, too controversial for most retailers… and far too dangerous for their profits.

That’s because after reading through these secrets, you may no longer be at the mercy of pushy salesmen, unscrupulous brokers and manipulative marketers who would have you pay way more than you should for everyday products and services.

Instead, you’ll be the one with the insider knowledge and the power to get what you want at prices your friends won’t believe you’re allowed to pay (if you dare to tell them).

Why Are You Passing Up All This Free Stuff?

Laissez Faire’s Big Book of Free is chock-full of proven tricks, loopholes and insider secrets to living a higher-quality, wealthier, healthier and more successful life.

Whether you want to retire in style… travel the world… work for yourself… take more time off to do what you want… try out a new lifestyle… raise your standard of living…

OR simply save up to tens of thousands of dollars each year to stuff away for the future…

You’ll find all you need tucked inside Laissez Faire’s Big Book of Free.

I promise. And I’ll prove it.

I’ll give you immediate, digital access to Laissez Faire’s Big Book of Free — and you’ll soon see what I mean.

For example, let me quickly show you what your life could look like with just a few more simple secrets inside Laissez Faire’s Big Book of Free…

Picture yourself turning on your computer in the morning. You log into your email, sip your coffee and notice 10 (or more) easy ways to make money in the next couple hours.

These simple moneymaking opportunities could show you how to quickly fatten your retirement account in a couple months — or how to get yourself out of that dead-end job.

You can choose to do all of them, a few of them or none of them. There can be brand-new opportunities to choose from tomorrow. That’s why you know it’s really no big deal if you don’t get to them today.

Now, let’s fast-forward to that evening.

Imagine walking right up to the ticket booth at your favorite movie theater or a sold-out concert and picking up another set of free tickets. You grab the tickets and look back at your friends as they stand there in astonishment.

They just can’t figure out how you keep getting so “lucky.”

Or what about receiving a package a week (or more) of free gifts? And I’m not talking about shampoo and snack samples.

One week, you could receive a free custom-built golf club and brand-new golf balls. The biggest brands in the game are always looking for golfers to test their new products. I’ll show you exactly how to claim yours on Page 127 of Laissez Faire’s Big Book of Free.

The week after, you might open up a small package with a “master ticket” to get into 150 museums across the United States. You’ll find out how to claim this on Page 29.

And the next week, you might receive an unusual lifesaving device about the size of a deck of cards. If you’re ever in danger, simply turn it on and it will talk you through how to use it.

Yes, it’s strange, but it could save your life someday. You’ll learn more about this weird device, and how to get it absolutely free, on Page 70.

Like everything else, it’s yours free with your trial subscription to the Laissez Faire Letter.

Your THREE Free Gifts

Are Waiting for You

Here’s everything you’ll receive with your trial subscription…

- FREE Gift #1: Trump’s No-Tax Plan: What Every American Needs to Know Before the End of the Year. Inside this special report, you’ll get every detail about potentially creating a million-dollar fortune using just tax savings… while satisfying IRS requirements.

- FREE Gift #2: Get What Congress Gets. Congress and Hillary Clinton have been getting away with something BIG. More than 41 lucrative benefits the public DOESN’T know about. But that all changes today. You can legally and ethically exploit loopholes in the system to claim many of Congress’ own benefits without having to steal taxpayer money, without having to take bribes and without pissing anyone off.

- FREE Gift #3: Digital Access to Laissez Faire’s Big Book of Free. It’s loaded with 127 ideas, tricks, hacks and loopholes to traveling where you want… working when you want… making hassle-free money… eliminating retirement worries completely… and living your dream lifestyle. It’s our best research yet, and I’m proud to send it to you free of charge just for trying us out for a full year.

- Yearlong Access (12 Monthly Issues) to the Laissez Faire Letter. This monthly newsletter shows you continued ways to legally lower your tax bill… strategies for a safe and secure retirement… ways to protect your family during a crisis… how to customize your health insurance to fit your exact needs… the best way to buy and store precious metals… and more.

Considering just one of these tax tricks could lead to as much as $20,000 in savings…

We could easily justify charging $197 a year or more for the Laissez Faire Letter.

After all, some people pay CPAs thousands of dollars for the tax savings advice alone.

But today, through this special offer…

You will have access to a TEAM OF EXPERTS who specialize in providing solutions for multiple areas of your life… for pennies on the dollar, comparatively.

So what’s fair to you?

$150? $125? $99?

Well, here’s the good news…

You won’t pay anywhere near that price, for two reasons.

First, our costs are divided across thousands of subscribers all over the world.

Second, we have made it our mission to share our ideas on health, wealth and living a happy life with 100,000 people.

We know that in order to meet our goal, we need to make it as affordable as possible for you to try our research.

That’s why today… through this special offer… a yearlong trial subscription to the Laissez Faire Letter costs just $49.

Which Path Will

You Choose?

Think of all the money that’s been slipping through your fingers…

Making it harder for you to grow your nest egg or build the type of life you’ve always wanted.

Well, now you’ve seen that it doesn’t have to be that way.

You can easily cut your taxes by thousands of dollars. All it takes is the know-how and as little as 30 minutes every month.

After that, you could have more money to spend on the things you enjoy!

A better car… better vacations... more money in your bank account.

You could have all these things without working one extra minute… without asking your boss for a raise… without scrimping and saving... and without having to return to the workplace.

As I see it, you have three options.

OPTION #1: You can forget you ever read this letter and continue exposing yourself to high taxes… controlled health care… and pay-nothing savings accounts.

OPTION #2: You can continue to do your own taxes… rely on the advice of your friends, a conservative accountant and the media… and hope for the best. (Not much better than your first option.)

OPTION #3: You can click the “SUBSCRIBE NOW” button below, become part of the Laissez Faire family and immediately begin living a healthier, wealthier and wiser life.

I’m sure you’ll choose the path that’s right for you. So click the “SUBSCRIBE NOW” button as soon as possible.

Your reports… your subscription… they’re all waiting for you just seconds from now.

And here’s one more thing…

All the Risk Is Ours

It's important to make sure you know your free reports and trial subscription are backed by our unique 100% LIFETIME SATISFACTION GUARANTEE.

This means that the Laissez Faire team personally pledges you'll never find research this good — and this rare — anywhere else.

If you decide we’re wrong, simply cancel anytime during the life of your subscription. Even on the very last day, as your last issue rolls in the door.

It's that simple. You don't even need to give us a reason. We’ll issue you a FULL REFUND of your paid subscription, no questions asked.

Naturally, you won't need to send back a thing.

Everything you've already received will be yours to keep, with my compliments.

It's easily among the most comprehensive guarantees ever offered anywhere.

And we’re happy to do it, because we believe this research will change your life for the better. We’re confident you'll come to believe in it too, once you give it a try.

But as the saying goes, the secret to getting ahead is getting started.

So I hope I'll hear from you soon. All you have to do is click the “SUBSCRIBE NOW” button below.

Subscribe Now

To a stress-free… tax-slashing season,

Gail Dent

Researcher, Laissez Faire Letter

December 2016

P.S. Remember, you must act on one of these strategies before December 28 at 5 p.m. If you do just one thing today, take 15 minutes to fill out this one form. It could mean $20,000 in savings this year, next year and the years to come.

Get the full details now.